|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Cheapest Mortgage Rates Today: How to Find and Secure ThemIn today's dynamic financial landscape, securing the cheapest mortgage rates is a priority for many homebuyers and homeowners looking to refinance. This guide will walk you through the strategies to find the best rates available, and help you understand the factors that influence these rates. Understanding Mortgage RatesMortgage rates are influenced by a variety of factors, including economic indicators and borrower qualifications. Understanding these can help you navigate the market more effectively. Key Economic IndicatorsSeveral economic factors influence mortgage rates, such as inflation, employment rates, and the Federal Reserve's policies. When these indicators point to economic growth, rates may increase to keep inflation in check. Borrower Qualifications

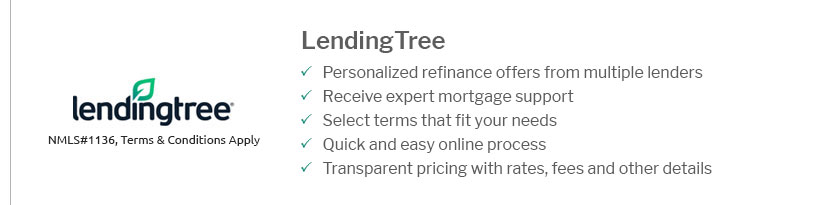

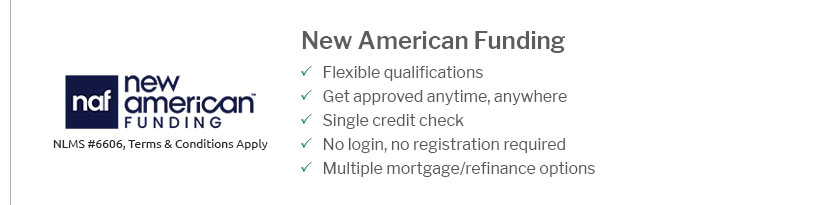

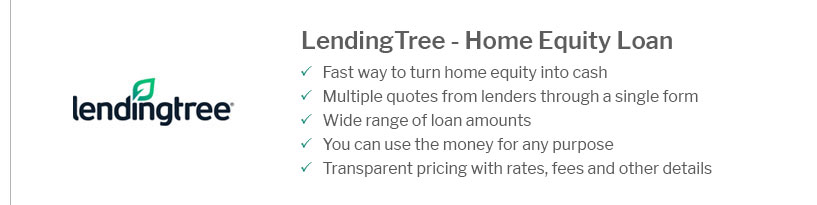

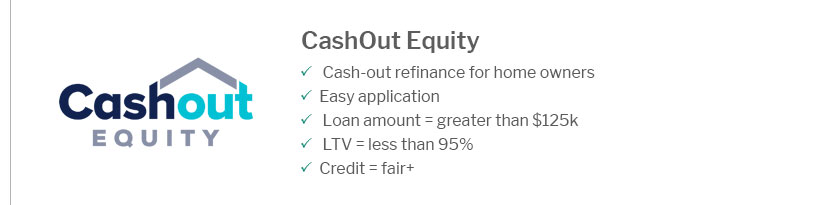

Finding the Best Mortgage RatesTo find the best mortgage rates, it is essential to compare offers from different lenders. Online tools and local advisors can assist in this process. Using Online ResourcesOnline platforms provide a convenient way to compare rates. Websites like low income mortgage offer valuable insights into affordable mortgage options tailored for different income levels. Consulting Local ExpertsEngaging with a local mortgage advisor can offer personalized advice and access to exclusive deals. Search for mortgage refinance near me to find nearby professionals who can assist with your refinancing needs. FAQ Section

What factors determine mortgage rates?Mortgage rates are determined by economic conditions, borrower qualifications, and market demand. Key factors include inflation, employment statistics, and the Federal Reserve's interest rates, as well as the borrower's credit score and financial health. How can I qualify for the lowest mortgage rates?To qualify for the lowest mortgage rates, focus on improving your credit score, maintaining a low debt-to-income ratio, and saving for a substantial down payment. Consistently paying bills on time and reducing outstanding debts can also enhance your creditworthiness. Are online mortgage rate comparisons reliable?Yes, online mortgage rate comparisons are generally reliable and provide a good starting point for understanding available options. However, it's essential to verify the rates with lenders directly to account for any specific fees or conditions that may apply. In conclusion, finding the cheapest mortgage rates today requires a blend of market awareness and strategic financial management. By understanding the influencing factors and utilizing available resources, you can secure a mortgage that best suits your financial situation. https://www.bankofamerica.com/mortgage/mortgage-rates/

Today's competitive mortgage rates ; 30-year fixed - 6.750% - 7.020% ; 20-year fixed - 6.625% - 6.964% ; 15-year fixed - 5.750% - 6.221% ; 10y/6m ARM variable - 6.625%. https://www.totalmortgage.com/mortgage-rates

Compare today's mortgage rates. The current mortgage rates are as low as 6.000% for a 30-year fixed mortgage as of March 26 2025 4:15pm EST. https://www.usaa.com/inet/wc/bank-real-estate-mortgage-rates

For VA Jumbo V A Jumbo Interest Rate Reduction Refinance Loan rates, call 800-531-0341.

|

|---|